When it comes to gift giving, the taxman is always watching. That’s because any gifts you give may be subject to gift taxes. The good news is that there are many ways to avoid paying taxes on your gifts.

Here’s what you need to know about personal gifts and taxes.

The first thing to understand is that not all gifts are taxable. For example, if you give a gift of cash or property that is less than $15,000 in a year, you will not owe any gift tax.

Additionally, there are many other types of gifts that are exempt from taxation, including charitable donations and most medical or educational expenses paid on behalf of another person.

Gifting & clarifying the $15,000 Gift tax rules

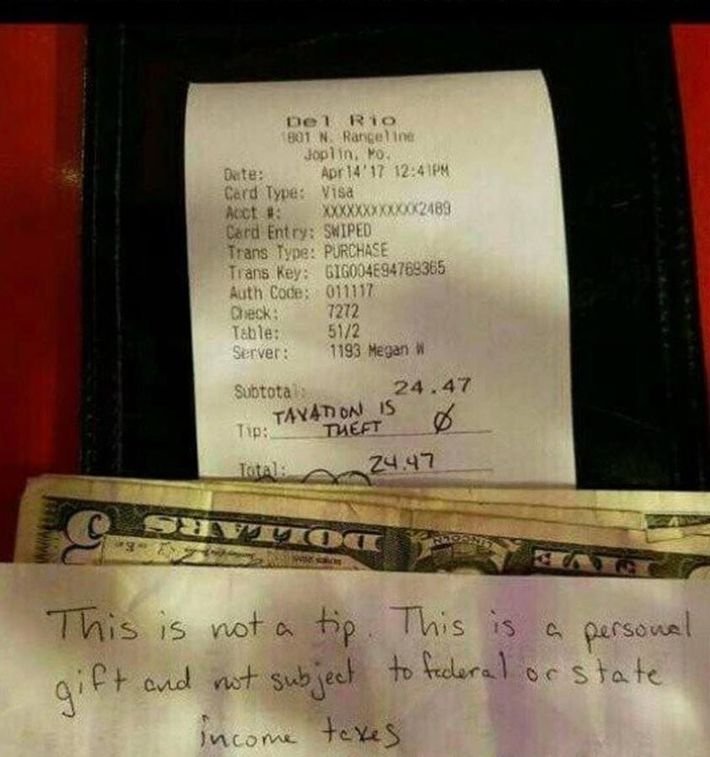

When it comes to taxes, there are a lot of gray areas. And one area that is often debated is whether or not personal gifts are taxable.

The IRS has stated that personal gifts are not taxable as long as they are less than $14,000 per year.

However, some people argue that any gift, no matter the amount, should be taxed.

There are a few reasons why people believe personal gifts should be taxed. First, they argue that when you give someone a gift, the recipient usually benefits more than the giver.

Second, they say that gifts can sometimes be used to avoid paying taxes on other income or assets. And third, they believe that taxing personal gifts would level the playing field between those who give and those who don’t.

At the end of the day, it’s up to each individual to decide whether or not they think personal gifts should be taxed.

What do you think?

Are Personal Gifts Taxable near Texas

When it comes to taxation, the state of Texas is pretty generous when it comes to personal gifts. In general, gifts are only taxable if they’re considered “income” – so things like wages, tips, interest, and dividends are all subject to state taxes. Gifts from friends and family are not considered income, so they’re not taxable in Texas.

However, there are a few exceptions to this rule. If you receive a gift that’s considered “property,” such as a car or a piece of jewelry, you may be subject to property taxes on that item. And if you receive a cash gift that’s more than $10,000 (from anyone), you’ll need to report it on your federal tax return – though the money itself isn’t subject to any additional taxes.

So in short: most personal gifts aren’t taxable in Texas, but there are some exceptions. Make sure you know the rules before you accept any big presents!

Credit: www.shrm.org

Do I Need to Declare a Gift As Income?

If you receive a gift, you do not need to report the gift as income on your tax return. The IRS defines a gift as “a transfer of property by one individual to another while receiving nothing, or less than full value, in return.” Gifts are generally not subject to taxation; however, there are some exceptions.

The first exception is if the gift is considered “income in respect of a decedent.” This means that if the person who gave you the gift dies within one year of giving it to you, the fair market value of the gift is taxable as part of their estate.

The second exception is if the gift is from a foreign person or entity.

Gifts from foreign persons or entities are generally taxable under the same rules as income from other sources.

Lastly, gifts can be subject to “gift taxes.” Gift taxes are imposed on the donor of the gift, not the recipient.

However, if the donor does not pay the taxes due on a gifted property, then responsibility for paying those taxes may fall on the shoulders of the recipient.

In general, gifts are not considered taxable income and do not need to be reported on your tax return; however, there are some exceptions to this rule. If you have any questions about whether or not your particular situation warrants declaring a gift as income, please consult with a tax professional.

How Does the Irs Know If I Give a Gift?

It’s no secret that the IRS is aware of most financial transactions that take place within the United States. So, it should come as no surprise that the agency also knows when gifts are given. Here’s how it works:

When a gift is made, the giver is required to file a gift tax return. This return must include information about the recipient, the value of the gift, and any applicable gift tax paid. The IRS uses this information to keep track of gifts made throughout the year.

If you’re wondering whether you need to file a gift tax return for a particular gift, there are a few things to consider. First, determine if the gift exceeds the annual exclusion amount. For 2019, this amount is $15,000 per person (meaning you can give up to $15,000 to each person without having to file a return).

Next, consider whether you’ve given more than $5 million in your lifetime (this figure includes all gifts made during your lifetime, not just those made in one year). If either of these thresholds is met, then you must file a gift tax return.

Of course, even if you don’t meet either of these criteria, you may still need to file a return if state law requires it or if special circumstances apply.

For example, some states have their own rules regarding gifting—so be sure to check with your state’s taxing authority before making any large gifts. Additionally, certain types of property may require a different type of return (e.g., real estate or interests in closely held businesses).

Can My Parents Give Me $100 000?

Yes, your parents can give you $100,000. However, there may be some tax implications for both you and your parents that you should be aware of before they make the transfer.

If your parents are gifting you the money as a true gift with no strings attached, then they will not owe any taxes on the transfer.

However, if they are loaning you the money or expecting to be repaid at some point, then different rules may apply.

For you as the recipient of the funds, if this is a true gift then you will not have to pay taxes on it. However, if it is considered a loan, then you may have to pay taxes on the interest that accrues on the loan amount.

It’s always best to consult with a financial advisor or tax professional before making any large financial gifts or loans between family members to make sure everyone understands the potential implications involved.

How Much Money Can Be Legally Given to a Family Member As a Gift in 2020?

In 2020, an individual can give up to $15,000 to any other person without triggering a gift tax. This is the maximum amount that can be given without incurring a tax liability, and it applies to both cash and non-cash gifts. If you give more than $15,000 to any one person in a year, you must file a gift tax return.

However, you will not owe any taxes as long as your total lifetime gifts do not exceed the estate tax exemption ($11.58 million in 2020).

Conclusion

When it comes to gifting, the rules can be confusing. Are personal gifts taxable? Read on to learn more about the taxation of gifts.

The general rule is that gifts are not taxable. However, there are some exceptions to this rule. If you give a gift that is considered a “substantial interest” in property, then it may be subject to taxation.

Additionally, if you give a gift that exceeds the annual exclusion amount, it may also be subject to taxation.

The best way to avoid any confusion is to consult with a tax professional before making any large gifts. They can help you determine if your gift will be subject to taxation and help you plan accordingly.